We fight for our clients

Maple Street was founded on the belief that we could level the playing field for our clients by revolutionizing how they manage their vendor relationships.

We strive to continue to grow our business by transforming the way the market manages its vendors to deliver a positive return.

We support this mission by providing the best service and value to our clients through The Vendor Advantage System® so our clients can compete and prosper.

Our Values

Solutions-oriented

Act like an owner.

Be accountable.

360 perspective

Look for and consider

all perspectives.

Emotional intelligence

Be self-aware.

Be other aware.

Integrity

Always be honest and

do the right thing.

Innovative

Be creative and curious.

Be a lifelong learner.

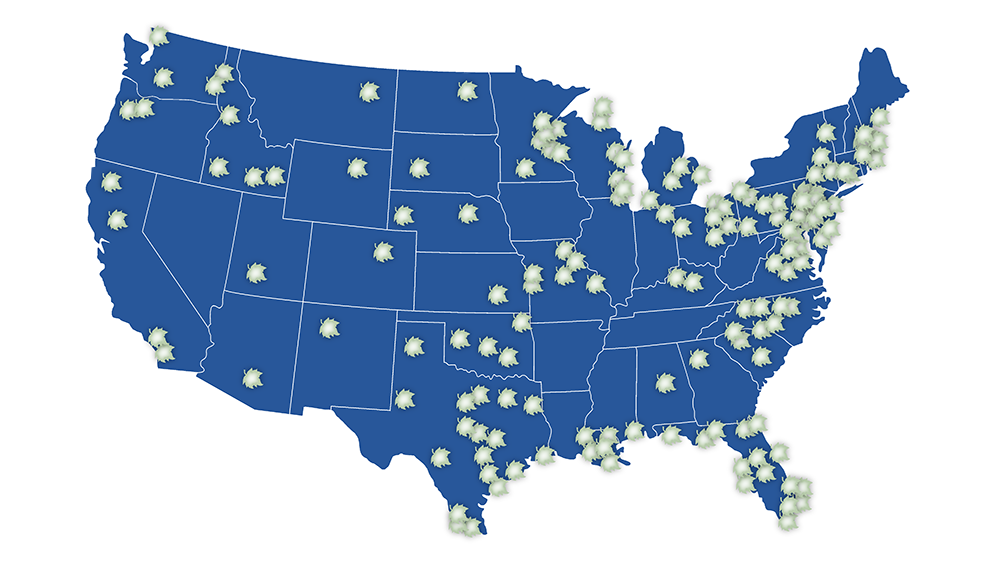

Our clients

Our history

In 2003, Maple Street founder Mike Crofts was negotiating vendor contracts for credit unions and community banks. To his surprise, he discovered his clients weren’t managing their vendor contracts, resulting in loss of revenue and chaotic vendor management relationships. Seeing an overwhelming need, Mike started Maple Street as a contract management service and the business took off.

Our Industry Knowledge Working For You

The Maple Street team quickly noticed a lack of consistency and discipline was prevalent throughout the industry. Some clients were paying vendors more—sometimes a lot more—than others. Contracts weren’t visible and continually rolled over on automatic renewals or clients renewed contracts without negotiating them because they believed there was no negotiation power.

"Maple Street has saved its clients millions of dollars in vendor costs since 2003."

Sharing Knowledge

What Does Culture Have to Do With Vendor Management?

At Maple Street we have been advocates for doing vendor management differently for 20 years. We have told our clients to chuck the check list

Stop rearranging the deck chairs on the Titanic: Why patchwork vendor management doesn’t work

Recently, a CEO of a credit union reached out to us with a story that is all too familiar in vendor management. For years, two

Cornerstone Advisors Acquires Maple Street

SCOTTSDALE, Ariz., March 5, 2024 – Cornerstone Advisors, a leading management and technology consultancy for banks, credit unions and fintech firms, announced it has completed its acquisition of

Our Partnerships

Argos Risk is a leading provider of third-party risk intelligence solutions. Argos Risk provides an affordable web-based subscription service that helps companies proactively manage third-party risk intelligence and business viability risks associated with their third-party relationships, including vendors, ACH/RDC originators, and direct and indirect lending clients.

The Cooperative Credit Union Association (CCUA) is a regional trade organization serving nearly 200 member credit unions located in Delaware, Massachusetts, New Hampshire and Rhode Island. CCUA engages its member credit unions by empowering them, individually and collectively, to provide consumers with outstanding financial services.

Credit Union Services, Inc. (CUSI) is the Service Corporation of the MD & DC Credit Union Association and connects credit unions with business solutions to help them drive growth and success. By anticipating industry trends and partnering with a select group of carefully vetted service providers, CUSI enables the Association to offer its credit unions best in class cost-effective solutions.

The California Credit Union League and the Nevada Credit Union League are the largest state trade association for credit unions in the United States. The leagues have played an important role in ensuring the sustained health of its member credit unions for over 80 years and help their member credit unions serve more than 13 million members across both states.

WolfPAC Integrated Risk Management is a secure, web-based enterprise risk management solution used to automate the identification of risks, threats and control gaps. WolfPAC® provides tools to review and monitor information technology, data security and privacy, third-party, regulatory compliance and other enterprise risk management domains. Since 2004, WolfPAC has worked collaboratively with clients to identify specific needs and provide next-generation solutions for organizations as the risk management landscape evolves. WolfPAC is owned by Wolf & Company, P.C. in Boston, Massachusetts. For more information about WolfPAC, call (617) 439.9700 or visit www.wolfpacsolutions.com.