Credit unions have been fighting for years to maintain viability to support their members and communities. Facing ever-increasing competition from other credit unions, banks and fintechs, now, more than ever, credit unions are relying on credit union service organizations (CUSOs) as one of the most powerful, sustainable forces in the industry to help secure the survival of credit unions in the U.S.

In 2014, rkGoBig was founded by a group of six credit unions located in the eastern U.S., each serving 5,300 to 20,000 members. It was developed with the understanding each institution often lacks scale and resources of its own to strengthen infrastructure and benefits, but together can develop scale, reduce expenses, and share services to better serve members.

Peter Barnard, CEO of rkGoBig explains, “Cooperation among credit unions is an intrinsic extension of the collaborative model of the institutions themselves – it’s in the DNA of credit unions and became a cultural attribute that fostered a climate for CUSOs.”

As someone who has spent his career helping credit unions, Barnard is particularly sensitive to the consolidation of the industry. “When I was first in the CU world there were only a small number of credit unions with $1 billion in assets or more. Through consolidation, that number has grown considerably and now we’re down from 18,000 small credit unions to only a few thousand and the numbers keep shrinking.” So rkGoBig was formed to serve small to mid-size credit unions.

Of the original founding credit unions of rkGoBig, only one had a full-time employee dedicated to compliance. Kamala Brody, Risk Management Officer / Compliance Officer at Century Heritage FCU was a natural fit for the CUSOˈs Compliance Officer position, acting as a shared resource for all member credit unions.

Maple Street’s reputation for exemplary compliance services initiated its relationship with rkGoBig

Brody knew it took expertise to review,

manage and negotiate vendor contracts. “Credit union attorneys are extremely valuable but, mostly, they’re highly specialized. No one has the expertise Maple Street brings to the table.”

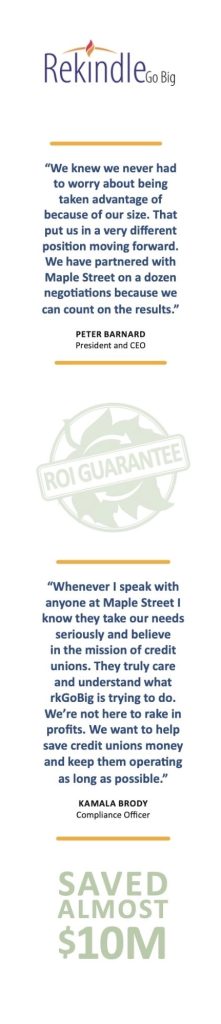

Barnard knew Maple Street would be an asset to rkGoBig after years of seeing his associates and their credit unions suffer from lack of direction about vendors and vendor contracts. “What we saw in Maple Street was an ability to be considerably more strategic than we ever could – which is just a word until you understand that means there’s so much complexity in all the varied vendor relationships and contracts,” he explained. Maple Street enabled the CUSO to stand up next to the highly paid lawyers and executive staff of large corporations and negotiate good terms and conditions, benefiting the entire group of individually small credit unions.

Barnard and Brody also touted Maple Street’s extensive industry knowledge: the information that is only discovered through years of fighting for credit unions to gain control of their vendor relationships and save their members’ money. Once the rkGoBig team witnessed the effectiveness of enlisting Maple Street for their compliance and negotiation needs, they immediately agreed it would benefit their employees and member credit unions to use the Vendor Advantage System®.

Barnard explained, “Adding the Vendor Advantage System® to regulatory services gave us an automated way to be more in control of our contractual obligations and expectations, which brought a degree of sophistication a larger financial institution would have.”

Recently, the two largest credit card processing companies in the U.S. merged – one was rkGoBigˈs existing vendor. Maple Street immediately met with the CUSO and worked diligently to develop a strategy for commanding the attention of what was essentially a new vendor.

The rkGoBig team was thrilled with the outcome. “All nine of our credit unions were integrated in the negotiation. That’s a massive undertaking, but we had Maple Street on our side, so it was a huge success.” Barnard added, “We reduced the cost of the contract, which increased the profitability of all nine credit unions. The net result was well over $1 million dollars in savings collectively for the credit unions and a more respectful relationship between our team and the vendor’s executive staff for the coming five-year contract. That one transaction commanded space, respect, and equilibrium in negotiations.”

Brody described her experiences with the company this way: “Maple Street truly cares about and understands what rkGoBig is trying to do. I’m completely at ease recommending Maple Street to anyone because its team has gained our trust and I know they won’t jeopardize my professional relationships.”

Barnard closed with: “A friend and mentor of mine always said, ˈTrust is truth, over timeˈ and I believe that whole-heartedly. When I think about the amount of emotion we have invested in the success of our credit unions, it can be difficult to trust vendors. But folks like Mike Crofts and his team at Maple Street have contributed mightily to relieve that. We consider them part of our mission.”