In 1948, Joe Pinkerton of Kansas City, Missouri, had a vision of his home city as a place where people would seek a better life, better job opportunities and better banking options. After petitioning the State of Missouri for approval, Joe founded Kansas City National Federation of Federal Employees Credit Union; with a share deposit of $5, the credit union welcomed its very first charter member.

Traveling from one railroad station to the next, Joe and his wife, Wyla, recruited more members by collecting cash deposits in a shoebox.

Fast forward 50 years, and the credit union changed its name to Mazuma, Yiddish for “money.” To this day, Mazuma preserves the core value of members investing together and actively serve to enrich not only the financial health of Kansas City, but also community development and the arts.

Deonne Christensen, who joined Mazuma as COO in 2013 and was named President/CEO in January 2019 said, “I joined Mazuma because I recognized the huge potential that this amazing organization had to make an even greater impact on all of the communities we’re here to serve.” She added, “I’ve been fortunate to be able to see that strong foundation being built; moving forward, we are focusing on immersing ourselves in all that is local and using our talented team, partners like Maple Street, and emerging technologies to fulfill our purpose of making Kansas City a better place to live, work and bank.”

Deonne came to Mazuma with over 20 years of banking experience ranging from part-time teller and investment banker to branch manager – the 10 years preceding her joining Mazuma as COO were spent helping transform a growing credit union with $460 million in assets to a large credit union with over $1 billion. “I loved banking, which is traditionally a semi-rigid industry, but I also loved grassroots operations and initiatives. When I transferred from a bank to Kitsap Credit Union, I found the perfect mix of the career I’d worked so hard to build and the ‘people helping people’ co-op environment,” she said. “I was able to help take this mid-size organization and, in 10 years, double the branches, create a corporate social responsibility program, assist in the successful launch of a major rebranding effort, drive migrations to new systems and turn it into a large-scale credit union. That was very meaningful to me.”

While attending management school, Deonne was introduced to Brandon Michaels, CFO of Mazuma. A few years later, upon Brandon being named CEO at Mazuma, he reached out to several credit union allies across the country. Mazuma was at a crossroads; business had become stagnant, membership was decreasing, systems were out of date and the credit union had not opened a new branch in over a decade. The board recognized Mazuma’s potential, however, and agreed the operation was well worth the significant time, money and energy investment necessary to completely re-brand and re-create infrastructure.

“I joined Mazuma as COO and we were in the exact position as Kitsap had been – down to the same $460 million in assets. I was excited to bring all the experience I had cultivated throughout my career and help Mazuma launch into this next chapter.”

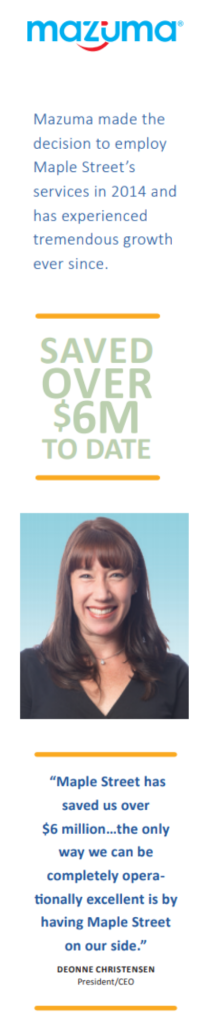

Mazuma made the decision to employ Maple Street’s services in 2014 and has experienced tremendous growth ever since. Deonne said, “We’ve done many system migrations, launched a Corporate Social Responsibility program, built a new headquarters, completely re-branded, developed a branching strategy to close and build multiple branches.” She added, “We even started the Mazuma Foundation and raised $1 million in three years – we were just able to grant $100,000 of that to local COVID relief. I’m really proud of everything we’ve accomplished and much of it wouldn’t have been possible without our relationship with Maple Street.”

The unfortunate decline in the number of credit unions in the U.S. has strengthened the cooperative nature of these institutions, making it more important than ever that they practice discretion when referring vendors to each other. “We have to make sure we’re doing business with people who not only have the individual credit unions’ best interest at the forefront of their operations but also that of the entire movement.” In addition, “It’s daunting to find vendors who operate that way so, if you do, it’s vital to share their value with other organizations. There are only two companies I refer regularly, and Maple Street is one – literally multiple times a week.”

Mazuma is one of Maple Street’s clients that recognizes the benefits of fully using the Vendor Advantage System®. In doing so, the credit union has been able to maintain its core values and focus on its team, members and community. “The Maple Street team has been a fantastic partner because we have countless active projects and initiatives for this massive restructuring and our priority cannot stray from the people. That’s impossible while managing hundreds of contracts, notices of intent, renegotiations, pricing and RFPs,” said Deonne. “But that’s a critical part of business – so we were blessed to find a company that could take that on and become part of our credit union team. They learned who we are and what we need so they can recommend vendors that align with our brand. That takes so much headache out of operations and changes the landscape of vendor relationships to be more symbiotic.”

The relationship between Maple Street and Mazuma has grown into one of the most successful partnerships to date. “Maple Street has saved us over $6 million, helped us increase services and negotiated more favorable vendor contract terms but, overall, they just keep us healthy and strong in the eyes of examiners and vendors. The only way we can be completely operationally excellent is by having Maple Street on our side. We consider them to be a department within Mazuma.”

View or share a PDF version of the Mazuma Success Story.

BCU: A new level of partnership – How Maple Street is helping a credit union accelerate vendor performance

BCU’s purpose is to empower people to discover financial freedom. As such, their tagline “Here Today For Your Tomorrow,” expresses their promise to support members throughout life’s journey and to offer everything they need to experience a bright financial future.

A Lasting Relationship: How Maple Street helped Buckeye Community FCU meet its members’ needs for 15 years (and counting)

Buckeye Community Federal Credit Union is a prime example of how a dedicated group of people in a small Florida town joined together to help each other, and as they grew, help their community. Learn how Maple Street has helped the credit union flourish over the past 15 years.

How Maple Street’s Vendor Advantage System® Empowered Heartland CU

Heartland Credit Union opened in 1948, owned exclusively by its members and located in the heartland of America: Kansas.